Become a Lender

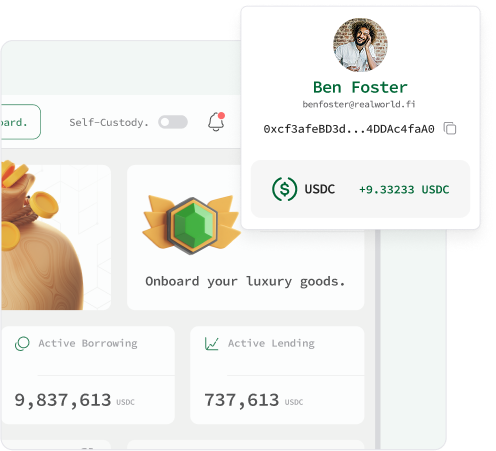

Unlock attractive returns by financing luxury assets secured by blockchain transparency and physical collateral, ensuring trust, stability and long-term passive income growth for every investor worldwide.

Become a lender now.

Earn returns on your cash by lending against hard assets in secure custody. Assets are worth more than the loans and will revert back to you in case of default.

Every loan is backed by fully insured luxury collectibles held securely in custody, ensuring protection, transparency and peace of mind.

Earn consistent, market-leading yields on stable, asset-backed loans. Typical APRs range from 8% to 15% depending on asset type and loan terms.

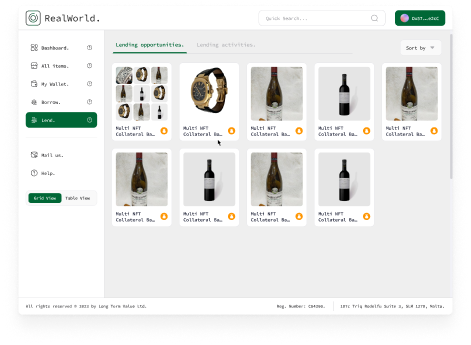

Real-time visibility into every loan via blockchain, giving you full confidence in your investments and ongoing performance tracking.

Choose loans matching your risk appetite, duration and preferred returns, with flexible terms and detailed asset-backed investment insights

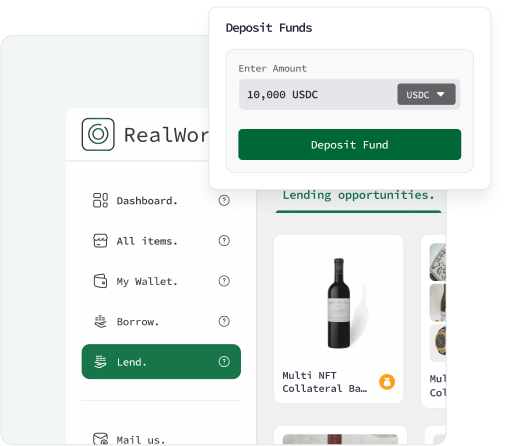

Discover the simple steps to start lending and earning. From onboarding funds to receiving passive income, it’s seamless, secure and fully transparent.

Onboard stable coins effortlessly and start lending in minutes, enjoying seamless, secure transactions with full control over your portfolio at every step. Benefit from transparent tracking, stable returns and flexible withdrawal options and maximum asset security.

Explore Details.

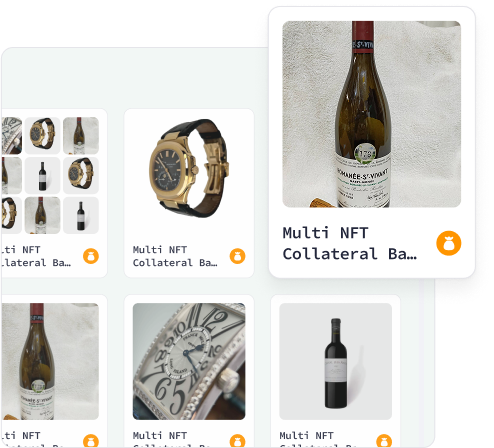

Choose only from trusted, verified borrowers who meet our strict standards. Invest in luxury assets that are thoroughly evaluated for quality, authenticity and value. Experience peace of mind with transparency and rigorous asset verification.

Explore Details.

Enjoy reliable monthly payouts directly to your account without any hassle. Your investments generate steady, passive income that grows over time. Experience financial freedom with consistent returns and transparent tracking.

Explore Details.Sign up today to unlock exclusive, high-quality lending opportunities tailored for smart investors.

Sign Up Now.

Every loan is backed by insured, high-value assets held in secure custody.

In the rare event of default, collateral is liquidated to recover your funds.

In case of borrower default, you have the right to foreclose on the luxury collateral. We offer optional assistance with liquidation, ensuring efficient asset recovery to safeguard your principal and minimize risk exposure. In some cases, recovering and selling the collateral may result in higher-than-expected returns.

Lend Now.

Everything you need to know about RealWorld.

RealWorld places client assets into insured vaulted custody globally to enable fast and efficient financing and trading. Because client assets are instantly visible to the global community 24/7 while remaining in safe custody, RealWorld is able to beat all other offerings on price, speed and loan parameters for asset owners, traders, borrowers and lenders.

Clients deposit assets at our secure partner custodial locations worldwide and RealWorld instantly connects our lender and trader client community to bid on an asset; all with instant settlement.

Client assets and ownership information are legally placed under a German Trust and are bankruptcy-remote from RealWorld’s operation. All client assets are appraised and authenticated by industry experts and remain in safe custody at professional insured vault facilities. All transactions are recorded and executed on the blockchain making the system transparent, immutable and with instant settlement. RealWorld deploys leading AML/KYC tools.

RealWorld accepts any luxury collectibles suitable for vaulted storage, including but not limited to precious metals, jewellery, art & fashion items, coins, investment wine and cars. We continue to expand our asset class offering.

RealWorld.fi offers clients the broadest functionality including asset appraisal and authentication, trading, lending and borrowing, transaction syndications, fractionalization, refinancing, sale and purchase of loans, loan prepayment and physical redemption of the underlying asset on demand.